Table of Content

According to Morissette , the increase in housing wealth was more important for immigrant families relative to non-immigrants. The same study showed that a lower proportion of immigrants invest in registered pension plans compared with Canadian-born individuals. Therefore, immigrants may leverage investments in housing as a retirement asset more than non-immigrants, which can lead to differing home buying preferences. The information is grouped by Income quintile , No immigrant buyers, At least one immigrant buyer, Median PIR, Median income, Median price, calculated using price-to-income ratio and dollars units of measure .

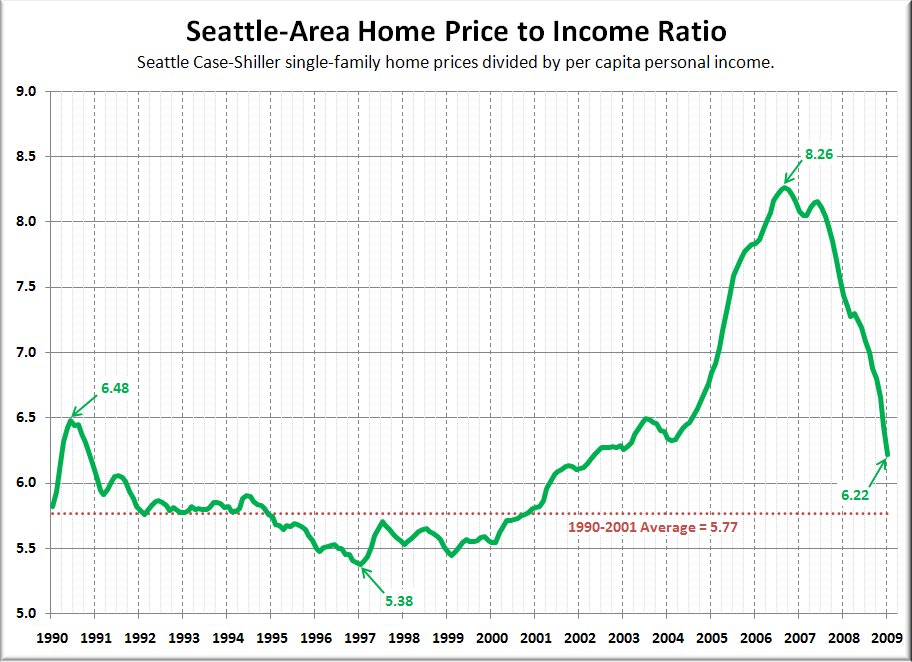

In other words, home prices increased 2.8x faster than income on average. From 2015 to 2020, the percentage of homes with underwater mortgages decreased by 54% in the most populous metro areas (from an average of 12.2% to 5.6%) — likely because rising home prices increased homeowners’ equity. From 2019 to 2021, the average house-price-to-income ratio increased from 4.7 to 5.4 — a 14.9% increase that’s more than double the recommended ratio of 2.6. Obviously home prices have risen considerably more than incomes over the past 30 years. But it’s easier to buy a home now because you only need 5% down and not 25%.

A snapshot of residential property owners

And not all recent homebuyers had to go through the stress test, which isn’t mandatory for all lenders, Petramala notes. The mortgage stress test, which Ottawa rolled out in two phases in 2017 and 2018, helps reduce the risk of higher borrowing costs. The test means federally regulated lenders must vet buyers’ finances to ensure they’d still be able to make mortgage payments with a higher interest rate. The question, Petramala says, is what will happen when many homeowners who bought in the current boom renew their mortgages five years from now. The benchmark home price, at $441,900, was more than six per cent higher than last year’s levels, although property values remain below their 2014 highs, the Calgary Real Estate Board said.

This subsection restricts the population to resident single-property owners. The owner income at the property level is obtained by summing the family income of all the property’s titleholders. Table 2 reveals that the value-to-income ratio was highest for the first income quintile and lowest for the fifth quintile in the CMAs of Vancouver, Toronto, and Halifax. The differences between the ratios for the lowest and highest income quintiles were more pronounced in the CMAs of Vancouver and Toronto relative to Halifax.

Canada House Price To Income Change

This table displays the results of Data table for Chart 1 HBA claimants, Owners who did not claim the HBA and Tax filers who did not own residential property, calculated using dollars units of measure . Claimants of the home buyers’ amount refer to individuals who claimed the amount ($5,000) in their federal income tax return form for the taxation year in which the home was acquired. As such, claimants of homebuyers’ amount represent a subset of all first-time home buyers, since some may omit to claim the amount, and include those who may have been homeowners in the past. Disposable incomes have outgrown home prices by about 5.8% since 2005. Due to recent growth, the US real estate market might technically be in a bubble.

Real estate always been wealth generator and will be all over the world in coming decades. In the 10 most expensive cities, the average house-price-to-income ratio leapt to 6.9 in 2021 — a 61% increase since 2000. The American dream of steady employment and homeownership has become increasingly elusive for Gen X, millennials, and younger generations. High, inflated home values mean that fewer Americans are underwater on mortgages.

Other statistics on the topicCanadian housing market

In Toronto, the average home price was hovering around eight times the average local household income pre-pandemic. For more than a decade, home prices growing much faster than incomes was an issue largely limited to Vancouver and Toronto, two of the country’s priciest and most active real estate markets. This was also the case in British Columbia, which has consistently been the most expensive province for housing. This is likely due to the fact that Vancouver, Canada's most expensive city, is located there.

The heterogeneity of this ratio across income quintiles is examined and the PIR of properties purchased by immigrants in British Columbia. This chart gives a different view of the data from the chart above, comparing the percentage change between UK house prices and average incomes over time. Historically, an average house in the U.S. cost around 5 times the yearly household income.

It’s straightforward, just measuring home prices divided by disposable income. When the ratio rises, home prices become more expensive relative to incomes. House prices varied widely across different provinces in the Netherlands, with Utrecht, North Holland, and South Holland being the most expensive provinces for a home purchase. In Utrecht, the average house price was double the price of a comparable property in the most affordable province, Drenthe.

Co-ownership patterns of claimants also varied by property type where more than half who bought a condominium apartment were the sole owners. Residential properties owned by the bottom 20% income earners had the highest property value-to-income ratio of 32.3 in the Vancouver CMA. I bought a crap townhouse in Sarnia Ontario south end, where I couldn’t sleep half the time because of flare stacks and shunting trains smashing together at 3AM. We are in a weird spot that there are jobs everywhere in towns and cities throughout Canada, many being quite affordable.

As disastrous as that sounds, the firm isn’t expecting a big housing crash the baseline model shows low to no price growth, as mortgage rates rise. This table displays the results of Before-tax income ranges of residential properties by quintile. The information is grouped by Income quintile , Vancouver CMA, Toronto CMA and Halifax CMA, calculated using before-tax income range units of measure . These high value-to-income ratios could be a result of property owners that may have acquired their properties in the past when assessment values were substantially lower, or may no longer be carrying a mortgage. Moreover, these owners may have earned pension income or accrued income outside of Canada, as the following findings show.

Ontario, British Columbia, and the Maritimes therefore appear to be more vulnerable, while the Prairie markets are less so, helped by a buoyant economic context. New data on claimants of the home buyers’ amount , a federal incentive program for first-time home buyers, provide insights on the characteristics of new entrants into the housing market and their first properties. The last part of this series examined housing affordability through the median price-to-income ratio. Another important consideration not captured in the income measure was accumulated wealth, acquired through previous homeownership, savings or financial support from individuals not included on the title.

Self-ish fools dismiss this as jealousy, not everyone can be a homeowner. That’s true, and aside from not everyone wants to be a homeowner, you’re forgetting that not everyone can absorb your home at the the price you think it’s worth. Among the 50 most populous metro areas, none saw the percentage of underwater mortgages rise since 2015 — likely because skyrocketing prices actually increased homeowners’ equity. In 2000, the average home value was $271,707 in the 50 most populated cities. By the 2008 housing crisis, average home values had jumped to $304,589 — a 24% increase. Today, home values have increased by an additional 39% to $376,826.

Category 5 is coloured dark purple and represents a ratio of 10.1 or more. It comprises 2 CSDs in the Vancouver CMA. Category 6 is coloured pale grey and is used for all areas within Canada where data are not available. Finally, Category 7 is coloured medium grey and is used for the United States of America.

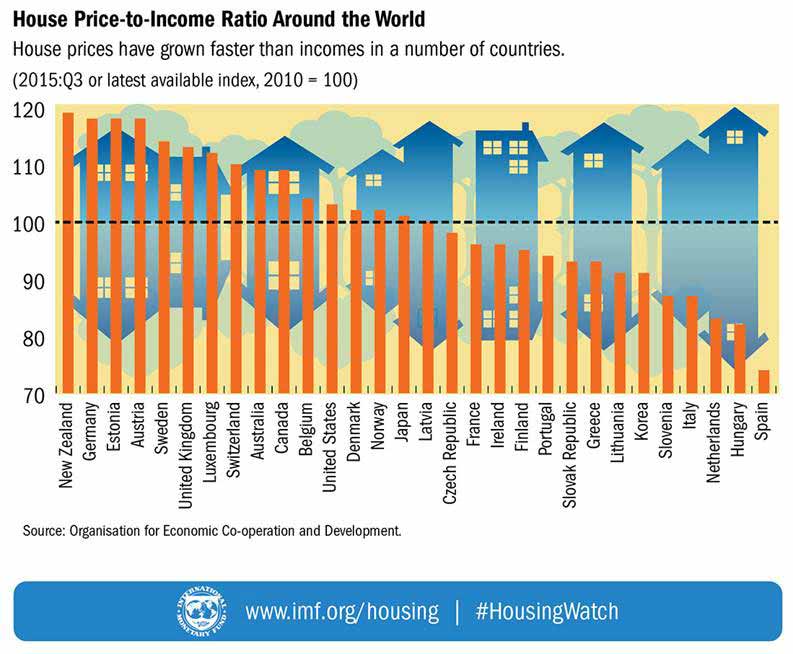

Organisation for Economic Co-operation and Development numbers show Canada topped the house price to income index. Canada’s gap between house price and income growth grew so fast, it tops the list of high-income, advanced economies. To calculate national statistics, we used median household income estimates and new residential home sale values from the U.S.

No comments:

Post a Comment